A new study finds that weakening or repealing Ohio’s prevailing wage standard is unlikely to save taxpayer dollars. In fact, a weaker policy would increase taxpayer burdens as construction worker incomes decrease and their reliance on public assistance increases. A weaker law would also mean fewer resources for apprenticeship training in this fast-growing sector, less work for Ohio businesses and Ohio workers, and negative overall impacts on the Ohio economy.

The study was conducted by researchers at Kent State University, Bowling Green State University, Colorado State University-Pueblo, and the Midwest Economic Policy Institute.

The key findings of the study are summarized below.

Full Report: The Economic, Fiscal, and Social Effects of Ohio’s Prevailing Wage Law [PDF]

Repealing Ohio’s prevailing wage law would increase costs for taxpayers.

- 76% of peer-reviewed research indicates no significant cost savings with prevailing wage repeal.

- Lower wages and benefits mean more construction workers qualify for public assistance.

- More of the Ohio’s tax dollars would be used to employ out-of-state contractors and workers.

Research specific to Ohio finds that repeal of prevailing wage would not result in cost savings.

- Federally-assisted school construction in Ohio provides recent evidence that Davis-Bacon prevailing wage requirements:

- Do not increase construction costs, but do increase bid competition.

- Result in more work for Ohio-resident contractors and their employees.

- Five other studies of Ohio schools find that prevailing wages do not increase construction costs.

- This includes the 2002 study by the Ohio Legislative Service Commission that finds no statistically significant effect of prevailing wages – when results are correctly interpreted.

- Labor costs are a low percentage of total construction costs (about 23% nationally).

Prevailing wage repeal means lower wages and more reliance on public assistance in Ohio.

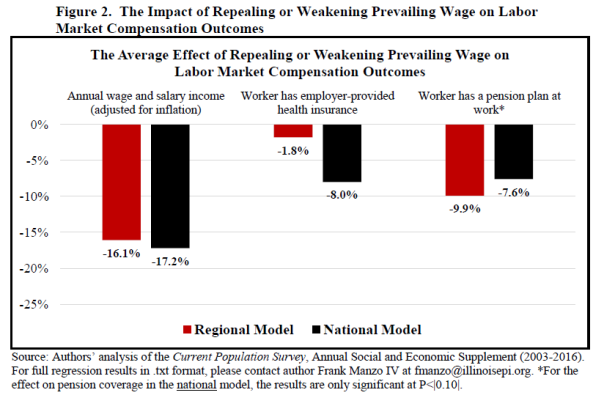

- Repeal would lower the income of all construction workers by 16%.

- An estimated 3,900 blue-collar construction workers would lose their employer-provided health insurance coverage and another 21,700 would lose their employer-provided pension plan.

- An estimated 16,000 Ohio construction workers would fall below the poverty line due to the severity of the wage cut, qualifying them for food stamps and Earned Income Tax Credit benefits.

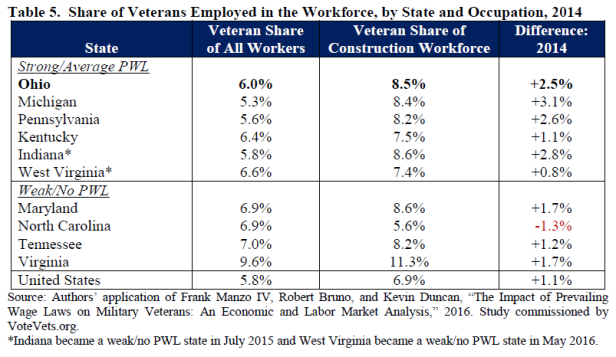

Repeal of prevailing wage disproportionately hurts military veterans.

- Ohio veterans work in construction at higher rates than non-veterans.

- Repeal would result in 4,100 blue-collar veterans separating from their construction jobs.

- The market share of veteran-owned construction companies would decrease.

Repeal of prevailing wage undermines workforce development in Ohio.

- The completion rate for Ohio’s building trades training programs is 21% higher than nonunion programs.

- 83% of Ohio’s apprentices graduated from building trades programs. 94% of female apprentices and 88% of minority apprentices are enrolled in these programs that spent $48 million on training in 2015.

- Ohio’s building trades and their signatory contractors contributed $1.75 billion in worker fringe benefits and training in 2015.

By undercutting local wage rates, repeal of prevailing wage would harm Ohio’s economy.

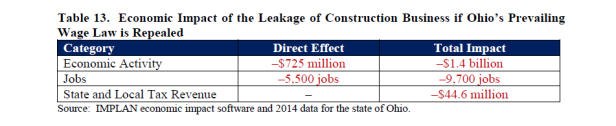

- Repeal would reduce work for Ohio-resident contractors and increase work by out-of-state contractors.

- Repeal would reduce economic activity by about $1.4 billion annually and cause an employment decline of 9,700 jobs – including 5,500 construction jobs and 4,200 retail and service industry jobs.

- The decrease in economic activity would reduce state and local tax revenue by $45 million.

Click here to read the full report.